Updates from August’s Microsoft Business Applications news. A sneak peek of the Credit Management

As announced in the last post of our blog series, we took a closer look at the new features of the first release wave 2020.

Quite early, namely already in February 2020 as early access, the enhanced credit management has been published. The enhanced credit management offers you the possibility to maintain detailed credit limits, risk assessments or insurance information directly in Dynamics 365 Finance and thus avoid losses due to non-paying customers.

For this feature, Microsoft has adapted the solution from DXC and included it in the standard as extended credit management for Dynamics 365 Finance. Since April 2020 (Microsoft Dynamics 365 Finance version 10.0.9 PU33) you can activate the feature via Feature Management – if you have switched off the automatic activation. But how good is the enhanced credit management for real?

Control detailed credit limit information directly from the customer master

Once the enhanced credit management is activated, it is soon obvious that additional fields are now available on the customer data sheet under Credit and Collections. These fields enable you to classify and group your customers and their credit rating much more precisely.

In addition to the classic credit limit, you can now, for example, also define a temporary credit limit. You can also group and manage several customers in one credit group. This enables you to control higher-level credit limits.

Please note the following: If a customer is defined in a credit group, the credit limit of the group always applies first. If the check is passed here, the system checks the limit for the customer. At the customer level, the system first checks the temporary credit limit, if one has been defined. Using this hierarchy, you can therefore already set up different credit limit levels.

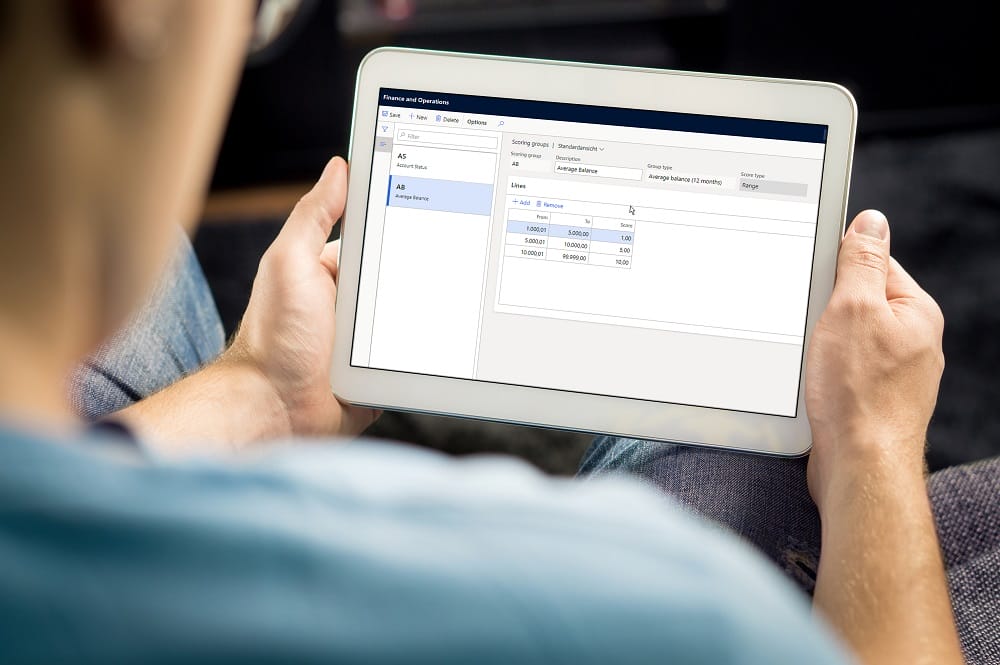

Create a risk classification and evaluate your customers according to individual scoring groups

As part of enhanced credit management, Microsoft also provides the option of risk scoring. For this purpose, you can define scoring groups of different types in the system. Microsoft offers seven standard Group Types, whose risk score can be calculated by the system via periodic tasks. The scoring groups are set up via the credit management setup in the Credit and Collections module. The Group Types include the average balance in the last 12 months, average payment days, the country of the customer or the age of the customer.

You can also create user-defined groups and values. However, you must manually maintain the risk values that can be determined using the user-defined groups on the customer.

The sum of the individual risk values per rating group results in a risk score for your customer, which allows you to identify to which risk group the customer belongs. To do this, you first create appropriate risk groups in the settings of the credit management via the risk classification.

You can also assign an indicator (colored symbol) to the individual risk groups to clearly distinguish the individual groups in evaluations and overviews.

The enhanced credit management also offers the possibility to set up automatic credit limits per risk groups. The automatic credit limits save you the trouble of setting up and managing the limits per customer or group. Depending on which risk group a customer is assigned to, the credit limit for the customer is adjusted. In this way, you ensure that a customer is automatically assigned the next lower credit limit, e.g. by the next overdue payment, and losses due to further overdue or uncollectible payments are minimized.

Define clear blocking rules, depending on credit limits, payment methods or open orders

In the enhanced credit management, you now also have the possibility to define blocking rules based on overdue payment periods, account status or payment method or the number of open orders in addition to the credit limit as a guideline.

These blocking rules can be set up either for all customers, customer groups or individual customers, as well as based on risk groups. This allows you to set up complex conditions and clear rules if necessary, which means that the system can already prevent the creation of further orders for risky or non-paying customers.

In addition, you will now also find an extra area for credit management on the sales order header with information on the blocking status. You also have the option of excluding individual orders from credit management and thus avoiding a block.

With the release of the enhanced credit management, Microsoft has provided a powerful tool that can help you to minimize sales losses by managing the solvency of your customers in detail.

Take the step and activate enhanced credit management. We at AlfaPeople are happy to help you with the set-up.